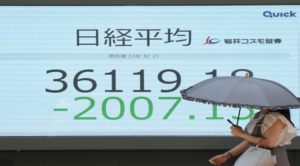

Japan’s Nikkei 225 index fell as much as 7.1% in the early hours of Monday, before regaining some ground. This continued the sell-offs that began last week.

The Nikkei lost more than 2,500 points at one time. At the Tokyo midday market break, the Nikkei was down 5.5% or 1,900 points at 33,945.43.

The TOPIX Index, which is a broader measure of the market, fell by as much as 7.8% and then recovered to trade at a loss of 6.6%.

Stocks fell Friday amid fears that the U.S. could crack under the strain of high interest rate measures meant to curb inflation. The Dow Jones Industrial Average future was down 1.5% and the S&P 500 future was 1.4% lower early Monday.

“To put it mildly, the spike in volatility-of-volatility is a spectacle that underlines just how jittery markets have become,” Stephen Innes of SPI Asset Management said in a commentary. The real question is: can the usual market reflex of selling volatility or buying the market drop prevail over the deep-seated fear brought on by the sudden and sharp recession scare?

The Nikkei 225 has fallen to its lowest level ever after a report showed that hiring in the U.S. was much slower than expected last month.

In a report, Yeap Jul Rong from IG stated that investors will be looking for data about the U.S. service sector due Monday by the U.S. Institute for Supply Management. This may help to determine if global sell-offs are an overreaction.

Taiwan’s Taiex, which is the market leader in Asia, saw its share of exports plummet by 7.4%. Taiwan Semiconductor Manufacturing Co., a market leader and maker of computer chips, lost 5.3%.

The Hang Seng Index in Hong Kong fell 2.1% to 16,945.51 while the S&P/ASX 200 index in Australia dropped 1.3% to 7,725.40. South Korea’s Kospi fell 3.4% to 2,570.64.

The S&P 500 fell 1.8% on Friday. This was its first consecutive loss of at least 1 percent since April. The Dow Jones Industrial Average fell 610 points or 1.5% and the Nasdaq Composite fell 2.4%, as stocks around the world and on Wall Street retreated.

The Nasdaq composite fell 10% after Friday’s tech stock losses. This level of decline is what traders refer to as a “correction.”

The crash began only a few days after U.S. stock indexes soared to their highest day in many months after Federal Reserve chair Jerome Powell provided the clearest sign yet that inflation had slowed down enough to allow for rate cuts to begin as early as September.

There are growing concerns that the Fed has kept its main rate too high, a level not seen in two decades, for far too long. This could be a contributing factor to the risk of a global recession. Rate cuts would help U.S. companies and households borrow more money, and this could boost the economy. However, it may take several months or even a full year before the full effect is felt.

Tan Boon Heng, a Singaporean economist at Mizuho Bank, said that the fear scenario is a higher unemployment rate that would further constrain spending and reduce incomes. This could lead to a downturn in the economy.

The world has been shaken by fears about the U.S. economic situation and the volatile market, even though it is not a recession.

The Nikkei 225 dropped 5.8% on Friday. The Nikkei 225 has been struggling since the Bank of Japan increased its benchmark interest rates on Wednesday. It is now back to the same level as when the year started.

The index’s sell-offs last Friday and Monday were the worst in its history. Its biggest decline was during the Black Monday market collapse of October 1987.

The modest hike in interest rates, from 0.1% to 0.25%, has pushed the Japanese yen up against the U.S. Dollar, which may hurt export profits and dampen a tourism boom. Investors are more concerned about the U.S. economic situation.

The dollar traded at 145.50 yen early Monday morning. This is a sharp drop from its previous level of more than 160 yen.